Industry overview

Global market conditions

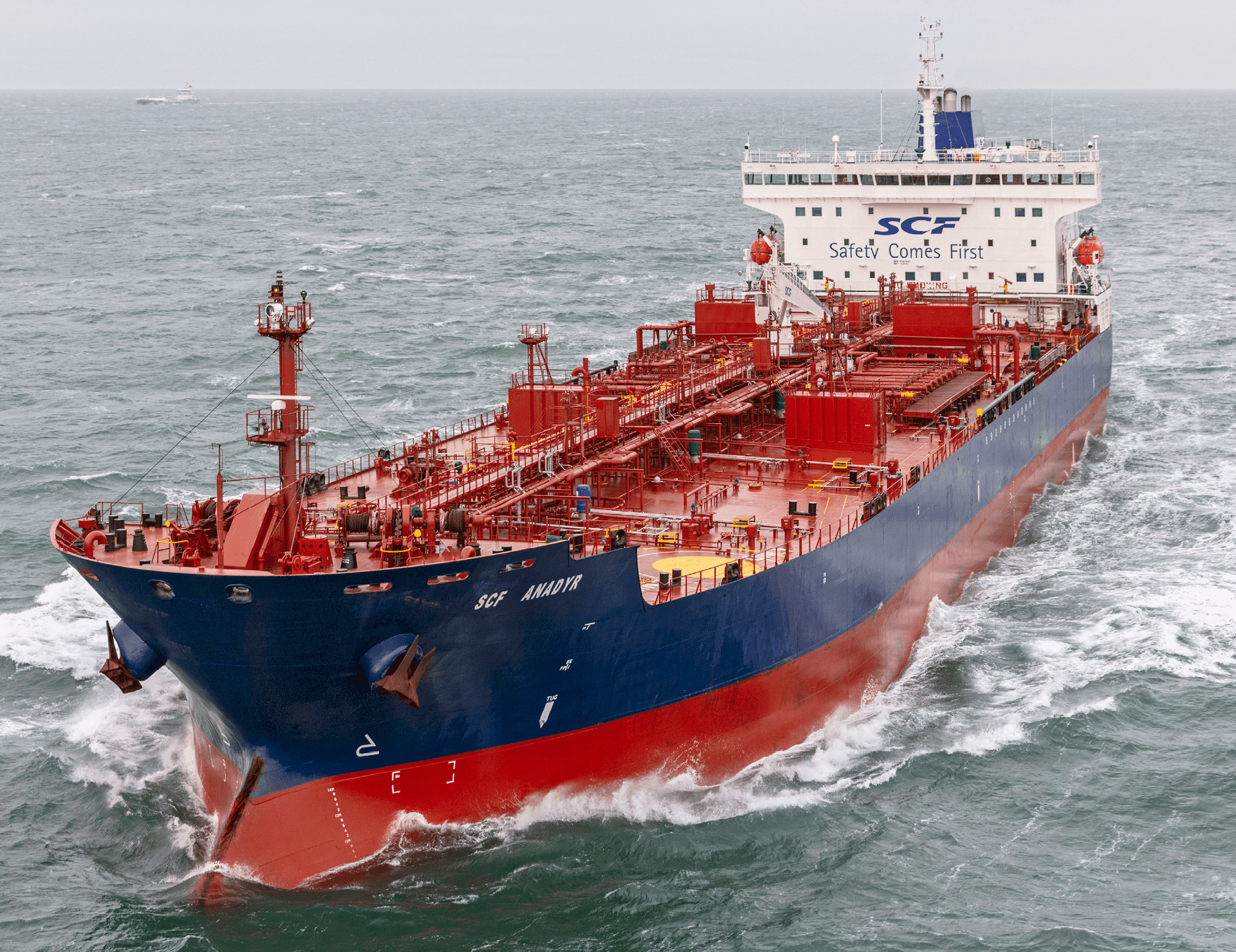

SCF Group is an integral link in the global energy value chain as an end-to-end solution provider involved in each step from exploration and production to distribution of products to end-users.

The Group is principally engaged in providing seaborne transportation services to the global energy industry, encompassing the following marine transportation sectors: crude oil, oil products, LNG, and LPG. In 2020, global marine transportation trade of energy commodities totaled an estimated 4.4 billion tonnes, equivalent to 38% of all seaborne trade. In addition to these sectors, SCF Group provides infrastructure and logistical services to the oil and gas industry using its shuttle tankers, icebreaking supply vessels and seismic vessels.

The freight and hire rates in the international marine transportation industry depend on a variety of supply and demand factors and while there is significant overlap between the sectors in which the Group operates, each sector has its own supply and demand drivers and underlying fundamentals. Generally, the primary determinants for freight and hire rates in the sectors in which the Group operates include:

- demand for cargo transportation;

- supply of appropriate vessels that are vailable to ship specified cargoes;

- seasonality in the demand for cargo transportation services, particularly within hydrocarbon industries;

- geopolitical factors;

- short-term influences, such as those caused by weather patterns.

Global energy trends

Trends in global energy consumption are broadly impacted by developments in the global economy, along with changes in population and demographics, energy efficiency developments and changes in technology. In 2020, the COVID-19 pandemic caused significant disruption to the energy sector, resulting in a sharp downturn in global energy demand. The IEA World Energy Outlook 2020 estimates that global energy consumption fell by 5% in 2020. Over the past few decades, slowing population growth and improvements in energy efficiency have led to a significant slowdown in energy consumption growth in developed economies, while urbanisation and faster population growth in developing countries have led to them becoming the key driver behind expansion in global energy demand.

Traditionally, global energy demand has been met largely by fossil fuels, namely oil, coal, and natural gas. While nuclear and renewables have also played a meaningful role for a number of decades, the share of fossil fuels remains relatively steady and dominant. The combined share of oil and gas in the global energy mix has remained relatively stable at approximately 54% between 2010 and 2019, with oil demand growing at a CAGR of 1.1% and gas demand at a CAGR of 2.2% over the 10-year period. Meanwhile, growth in coal consumption has slowed notably as environmental concerns have grown, with closures of coal-fired power plants in Europe and the U.S., new policies such as the Emissions Trading Scheme in the EU and air pollution measures in China all impacting consumption. These measures along with other initiatives to increase the share of cleaner fuels in the global energy mix, including fuel efficiency regulations, have encouraged expansion in natural gas and renewable energy consumption. Natural gas is typically seen as a relatively cleaner source of primary energy compared to coal, and is often referred to as a “transition fuel” to replace coal in ongoing decarbonisation efforts. Gas consumption has risen from an approximately 21% share in 2010 to approximately 23% in 2019. Greater supply availability and increasing LNG export capacity is expanding the accessibility of gas, which is likely to keep prices low and increase the cost competitiveness of gas in power generation. Meanwhile, the share of renewable energy (mainly hydro, solar and wind) has risen from approximately 13% to approximately 14%.

The COVID-19 pandemic is expected to leave a significant and lasting impact on the trajectory of energy demand going forward. In the short term, oil and coal demand have been the most heavily impacted, falling by approximately 8% and approximately 7% y-o-y in 2020, respectively, largely due to restrictions on mobility, declines in electricity demand and industrial production. The impact on gas consumption has been more moderate, with natural gas demand currently estimated to have fallen by 3% in 2020. Assuming that the worst impacts of the COVID-19 pandemic are overcome, global energy demand is expected to improve from the trough seen last year and resume year-on-year growth over the next decade, although the reduction in total global GDP as a result of impacts from the pandemic may put some limits on the magnitude of its recovery. Non-OECD countries are expected to be the key area of the growth in energy demand going forward, given these countries are expected to account for most of the growth in population, urbanisation and economic development in the foreseeable future. Meanwhile, developed nations in the OECD are focusing more on energy efficiency and low-carbon technologies.

According to the OPEC World Oil Outlook 2020, global primary energy demand is forecast to resume growth in the medium and long-term, with an average growth rate of 0.9% anticipated in the period 2019-2045. Natural gas is expected to be the fastest-growing fossil fuel over this period as a result of rising levels of urbanisation, growth in industrial demand and greater competitiveness in the power generation and fuel transportation sectors. Oil demand is expected to expand moderately over the next decade, retaining the largest share of the global energy mix, although the rate of expansion in global oil demand is expected to be limited by improvements in fuel efficiency and uptake of electric vehicles going forward and a more accelerated transition towards decarbonisation could moderate this further. While oil is projected to gradually lose market share, it is expected to remain a material part of global energy consumption (over 25%), with oil and gas together accounting for at least half of the global energy mix. Renewable energy sources are expected to remain the fastest growing source of energy over the outlook period.

The Russian oil and gas sector

Russia is a leading global producer of oil and gas. According to the 2020 BP Statistical Review of World Energy, Russia’s proven natural gas reserves stood at approximately 38 trillion cbm at the start of 2020 accounting for 19.1% of total global reserves. Meanwhile, Russia’s proven oil reserves stood at approximately 107 billion bbls, accounting for 6.2% of the global total. There may also be further unproven oil and gas resources in areas such as the Arctic.

In 2020, Russia’s total marketed natural gas production stood at an estimated 654 billion cbm, according to Clarksons Research, accounting for approximately 17% of global marketed natural gas production, making the country the world’s second largest producer of natural gas after the U.S.

Russia has significantly expanded its natural gas export capacity via LNG projects since the launch of the country’s first LNG export terminal at Sakhalin in 2009. At the beginning of March 2021, Russia’s LNG liquefaction capacity stood at an estimated 28mtpa, having more than doubled since 2009. A further 22mtpa of liquefaction capacity is currently under construction in Russia including 20mtpa at Arctic LNG 2, comprised of 3 liquefaction trains scheduled to start up between 2023 and 2026.

Russia exports significant volumes of crude oil and refined oil products. Approximately 80% of crude exported in 2020 was seaborne. In 2020 Russian seaborne exports registered an estimated decline of approximately 15% to 3.2m bpd (approximately 9% of global seaborne crude trade) as a result of the significant production cuts under the OPEC+ agreement. Nonetheless, Russia retained its position as the second largest seaborne crude oil exporting country after Saudi Arabia in 2020. However, in terms of estimated volumes transported on Aframax tankers, Russia stood as the largest exporter globally, with Aframaxes taking an approximate 75% share of Russian seaborne crude exports.

Key ice-class shipping region

As a number of Russian ports and oil and gas projects are located in areas where sea ice is often present, either during winter months or all year round, there is a significant demand for ice-class marine transportation in Russia, including oil tankers and offshore support vessels. To operate in ice affected waters, vessels require specialised features including strengthened hulls, enhanced propulsion and “winterization” features. In addition, operational experience is required. By virtue of their additional specifications, ice-class vessels are more expensive to build and operate than equivalent non-ice-class vessels.

Export facilities in the Russian East, at Sakhalin, require ice-class vessels, as do oil and product liftings from Primorsk, Vysostsk, and Ust-Luga and potentially, Portovaya. In addition, highly specialised ice-class offshore support vessels are required to support production fields in the Arctic and sub-Arctic regions, such as Sakhalin. Oil and gas export projects in the Arctic require even further ice-class specialisation in terms of vessels and their operation. Projects such as Varandey, Prirazlomnoye, Novy Port and Yamal LNG and new projects such as Arctic LNG 2 require the construction of project-specific vessels adapted uniquely to the geography of operations and are typically utilised for the entire lifecycle of the project.

Offshore support

Shuttle tankers

Shuttle tankers are specialised vessels designed to transport crude oil and condensates from offshore oil field installations to onshore terminals and refineries, and are equipped with sophisticated loading and dynamic positioning systems that allow vessels to load cargo safely and reliably from offshore oil field installations. Shuttle tankers are an integral part of the marine infrastructure for the upstream projects, and therefore the majority of vessels are chartered under long-term contracts for the entire useful life of offshore fields.

Most of the world’s shuttle tankers are serving offshore fields in the Arctic, Brazil, Canada, North Sea and Sakhalin. If a shuttle tanker is operating in cold weather conditions for extended periods of time it may be necessary for a shuttle tanker to have ice-class capabilities. As of March 1, 2021 there were 31 ice-class shuttle tankers in the world fleet and on order.

According to Clarksons Research, as at the beginning of March 2021, the global shuttle tanker fleet consisted of 123 ships with a total deadweight of 14.3 million tons. SCF Group was the third leading shuttle tanker owner in terms of the number of vessels (21 including vessels on order). Since all of these tankers are iceclass, Sovcomflot confidently holds first place in the world by the number of ice-class shuttle tankers . Knutsen NYK KNOT Offshore, Altera Infrastructure and Viken MOL AS are among SCF Group’s biggest competitors in this segment.

Support vessels

Platform Supply Vessels (the “PSVs”) are part of the Offshore Support Vessels fleet. Their primary function is to support offshore rigs and platforms through delivery of supplies. The PSV fleet is typically differentiated by capacity, either in DWT or deck area. The largest PSVs are commonly employed in ‘harsh’ environments such as the North Sea or deepwater areas such as the Gulf of Mexico.

Ice-breaking supply vessels (the “IBSVs”) are specialised vessels which provide logistical and ice breaking support services to offshore oil and gas platforms which operate in the most challenging weather conditions. Support can include supply services, crew transportation, early stage firefighting and rescue operations and provision of standby services to offshore installations. These vessels are designed and built to suit the particular needs of a field and are typically utilised for the entire lifecycle of the project.

LNG shipping

Growth of seaborne LNG trade is a key underlying factor expected to facilitate the increasing share of gas in the global energy mix. Global LNG tonne-mile trade growth is estimated to have grown by 7.7% in 2020 despite substantial COVID-19 related impacts on global demand for natural gas and LNG, with growing long-haul exports from the U.S. to the Asia-Pacific region helping to support vessel demand. Current projections for 2021 suggest further LNG trade growth of approximately 9% y-o-y.

In the longer term, the outlook for LNG demand appears encouraging, with LNG expected to play a key role in facilitating the growing share of natural gas in the global energy mix. LNG demand is also supported by global environmental agenda and shift away from coal and heavy fuel oil in favour of ‘clean’ burning natural gas. Within the marine transportation industry itself, LNG is gaining traction as a marine fuel and is often seen as a ‘bridging solution’ as shipowners consider means to achieve the IMO 2050 CO2 emissions target.

The following charts set forth development of LNG carrier fleet and orderbook (vessels on order at yards or presently under construction):

Construction of a newbuilding LNG carrier typically takes between 18 months and 3 years from contract signing to delivery of the vessel by shipyard, depending on schedule of the relevant shipyard’s orderbook. Number of shipyards that are capable and willing to construct LNG carriers is limited, restricting the ability to have an LNG carrier built within a short time frame.

Ice-class LNG carriers

Ice-class LNG carriers represent a relatively small proportion of the total LNG fleet and historically have often been purpose-built to facilitate exports from particular LNG liquefaction terminals. As at the end of the reporting period there were seven ice-class LNG carriers in the Group’s fleet, equivalent to approximately 10% of the global ice-class LNG fleet. As of March 1, 2021, there were a total of 26 ice-class LNG carriers on order, equivalent to approximately 17% of vessels on the LNG carrier orderbook.

According to Clarksons Research, as at 1 March 2021, the global fleet of ice-class LNG carriers, as well as the order portfolio, included a total of 76 vessels with a total cargo capacity of 10.9 million cubic meters. The SCF fleet in this segment, including the 14 vessels under construction ordered through joint ventures, includes a total of 25 vessels. As a result, the group is number one in the list of leading owners of ice-class LNG carriers. Major companies that own and operate fleets in the LNG shipping segment include Maran Gas, Mitsui O.S.K. Lines, GaslogGolar LNG, MISC, NYK Line, Qatar Gas Transport (Nakilat) and Teekay LNG, with only the latter listed as a leading owner of ice-class gas carriers.

LPG shipping

LPG carriers are employed in transportation of liquefied propane and butane as well as other hydrocarbon gases. Propane and butane are often used as petrochemical feedstocks, which is a fast-growing part of demand for LPG, particularly in Asia, and demand for their use as such is often dependent on the pricing compared to naphtha. The LPG fleet can be categorised by the vessel’s method of containment, with approximately 30% of LPG carriers in the world fleet having fully refrigerated tanks (in numerical terms) as of March 1, 2021. Clarksons Research estimates that between 2009 and 2019, seaborne LPG trade (liquefied propane and butane) grew at a CAGR of 6.9% per year.

Crude oil shipping

The international tanker market is cyclical in nature and is characterised by strong volatility due to strong fluctuations of freight rates, driven by often-unforeseen changes in tonnage demand and supply. Demand for tanker tonnage is affected by a number of factors, including supply and demand for crude oil and oil products, the availability of refining capacity and storages, the economic situation in global and regional markets, the distances over which oil and petroleum products are transported, and competition from other modes of transport. Supply in the tanker market is also affected by a number of factors, including the pace and quantities of new ship deliveries, old tonnage disposal rate, and changes in industry regulation.

According to Clarksons Research, as at 1 March 2021 there were 717 Aframax crude tankers in the global fleet, including vessels on order and under construction. Forty of them belong to SCF Group, and in this segment the company is number one on the list of leading tanker owners. Besides, Sovcomflot is the world leader by the number of ice-class crude tankers. SCF’s main competitors in the crude marine transportation services market are Frontline Ltd, Euronav N.V., Nordic American Tankers, MISC (AET), Minerva Marine Inc, Thenamaris and Teekay Tankers, which operate tankers of various types and sizes, including VLCC.

2020 was characterised by a high market volatility in the situation of negative influence of a drop in oil and oil products demand and quarantine restrictions due to the Covid-19 pandemic. Failed OPEC+ talks on cutting oil production in March 2020 increased cargo surplus and speculative demand for shipping and storage of cheap oil that led to a surge of spot freight rates in all oil tanker sizes. The agreements reached by OPEC+ in April to cut oil production generated a moderate growth in prices of crude oil and oil products, reduction in demand for transportation and tonnage surplus in the second quarter of 2020. That adversely affected the freight rates which reached a minimum return level by the end of a half year. In Q3 and Q4 the freight market situation was still weak amid the reduction in demand for oil products (in comparison to 2019 level), which led to a stagnation of the freight rates till the end of the reporting period.

On the back of peak values in March-April 2020, in the reporting year the ClarkSea Index See the Glossary. averaged US$24,249 per day, exceeding the average value for 30 years (US$20,781 per day).

| Vessel size category | 2020 | 2019 | Change, % |

|---|---|---|---|

| VLCC tankers | 53,145 | 41,364 | 28.48 |

| Suezmax tankers | 30,240 | 31,560 | –4.18 |

| Aframax tankers | 22,161 | 26,225 | –15.50 |

| Vessel size category | 2020 | 2019 | Change, % |

|---|---|---|---|

| VLCC tankers | 39,788 | 36,358 | 9.43 |

| Suezmax tankers | 27,899 | 26,649 | 4.69 |

| Aframax tankers | 22,329 | 22,091 | 1.08 |

Oil products shipping

Conditions in the oil products shipping market have been closely correlated with those in the crude oil shipping market. This is partly associated with the fact that some crude and product tankers have the potential to act as ‘swing tonnage’ between the crude, dirty and clean markets.

According to Clarksons Research, as at 1 March 2021, the global fleet included 358 high ice-class product

SCF Group owns product carriers of various sizes: Handysize, MR, LR I and LR II, and ranks eighth in the world in terms of the number of MR product tankers. Other leading product carrier owners and operators include BW Pacific, China COSCO Shipping, Ardmore Shipping, Scorpio Tankers and Torm A/S.

In the first quarter of 2020, the dynamics of freight rates in the product carriers segment were characterized by short-term spikes caused by the demand for floating storage. As the oil products market reached a balance between supply and demand, demand for oil products tonnage subsided amid the reduction in transportation volume due to seasonal factors and consequences of the COVID-19 pandemic, and the freight rates dropped to the lowest return level for shipowner by the end of half a year and remained at a low level during the third and fourth quarters of 2020.

| Vessel size category | 2020 | 2019 | Change, % |

|---|---|---|---|

| MR product carriers | 15,251 | 13,740 | 11.00 |

| Handysize product tankers | 13,881 | 14,560 | –4.66 |

| Vessel size category | 2020 | 2019 | Change, % |

|---|---|---|---|

| MR product carriers | 14,440 | 14,683 | –1.65 |

| Handysize product tankers | 12,995 | 13,425 | –3.20 |

The global conventional tanker freight market is considerably fragmented and is characterised by high competition and the absence of serious barriers for entry. The SCF Group’s share of the freight market in conventional segments does not exceed 1%. Any change in this indicator over the past three years is considered immaterial (less than 0.01%) due the continued presence of a significant number of fleet owners and operators, estimated in total at about 3,200 (including approximately 200 companies with a fleet of ten or more tankers).

Dynamics of new ship orders

Global new ship orders have fallen to historical lows, accounting for 8.35% of global deadweight capacity at the end of March 2021.

Sovcomflot positively evaluates prospects for industry cycle recovery upon an increase in oil products output as well as recovery of previous crude oil production and transportation levels.